Financial Assessment is crucial and more than just tracking your income and expenses. It’s a full-spectrum analysis that helps you understand where you stand financially, identify opportunities for growth, and prepare for the future. Whether you’re an employee, freelancer, or entrepreneur, a comprehensive financial assessment can dramatically improve your financial health and decision-making.

Starting at age 44, your energy, metabolism, and overall well-being may be silently declining. Don’t wait for symptoms.

Table of Contents

Table of Contents

What is a Financial Assessment?

Why You Need a Financial Evaluation

Step-by-Step Financial Evaluation Framework

A. Employment or Business Analysis

B. Income Review

C. Expense Tracking and Categorization

D. Savings Evaluation

E. Investment Portfolio Analysis

F. Credit and Debt Evaluation

G. Insurance Coverage Review

H. Emergency Fund Adequacy

I. Retirement Planning Status

J. Net Worth Calculation

Types of Investments by Professional Field

Additional Aspects to Consider

Red Flags and Warning Signs

How to Take Action Post-Evaluation

Final Thoughts: The Power of Knowing

1. What is a Financial Assessment?

1. What is a Financial Assessment?

A financial evaluation is a thorough examination of your current financial state. It involves analyzing every aspect of your finances to get a complete picture of your financial health. It’s like a medical check-up, but for your money.

Evaluating income streams

Categorizing expenses

Analyzing savings and investments

Assessing debts and liabilities

Projecting future financial needs

2. Why You Need a Financial Assessment

2. Why You Need a Financial Assessment

Financial clarity brings peace of mind and strategic power. Without a regular evaluation:

You may overspend unknowingly.

You might neglect critical areas like retirement or insurance.

You miss opportunities to grow your wealth.

Benefits include:

Improved decision-making

Early identification of financial risks

Better planning and budgeting

Enhanced financial discipline

3. Step-by-Step Financial Assessment Framework

3. Step-by-Step Financial Assessment Framework

A. Employment or Business Analysis

A. Employment or Business Analysis

Understanding your primary income source is the foundation.

For Employees:

Job security and industry outlook

Salary structure and bonuses

Opportunities for promotion

For Business Owners or Freelancers:

Profit margin trends

Customer/client stability

Seasonality and cash flow

B. Income Review

B. Income Review

Evaluate all sources of income:

Salary or wages

Freelance or side gigs

Rental properties

Dividends or interest

Government assistance (if applicable)

Ask yourself: Is my income growing, stable, or declining?

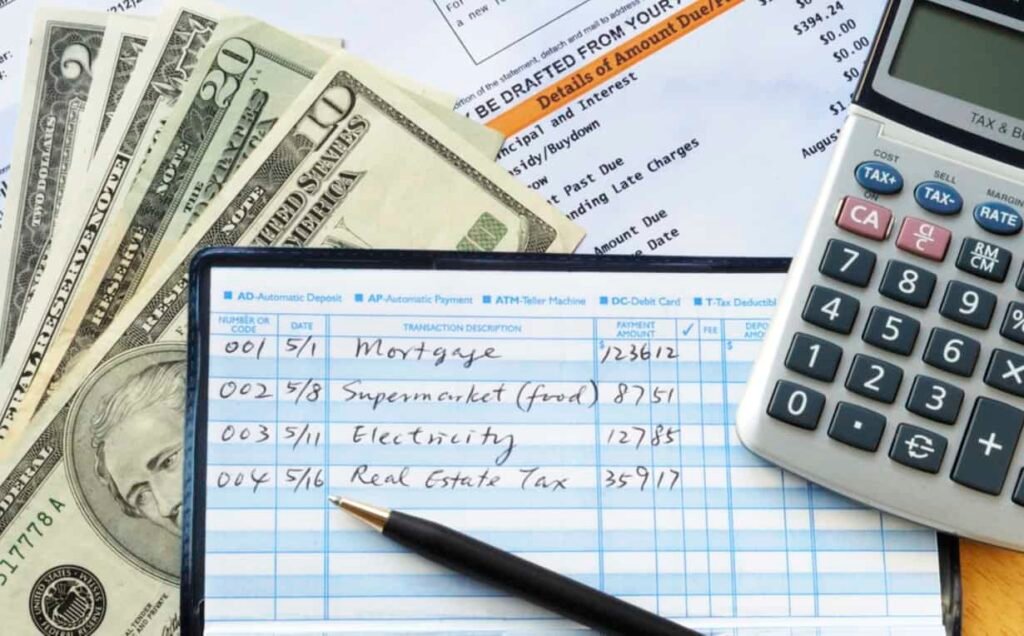

C. Expense Tracking and Categorization

C. Expense Tracking and Categorization

Categorize your expenses:

Fixed: Rent, utilities, loans

Variable: Food, transportation

Discretionary: Entertainment, subscriptions

Use tools like:

Budgeting apps

Spreadsheets

Bank statements

D. Savings Evaluation

D. Savings Evaluation

Are you saving regularly? Consider:

Monthly savings rate (aim for at least 20%)

Savings goals (short-term and long-term)

Savings vehicles (bank accounts, digital wallets, etc.)

E. Investment Portfolio Analysis

E. Investment Portfolio Analysis

What’s working for you, and what’s not?

Key areas to assess:

Types of investments (stocks, bonds, crypto, real estate)

Risk level vs. your risk tolerance

Diversification

Return on Investment (ROI)

F. Credit and Debt Evaluation

F. Credit and Debt Evaluation

Debt isn’t inherently bad—mismanaged debt is.

Evaluate:

Credit score

Debt-to-income ratio

Types of debt (good vs. bad)

Repayment plans

G. Insurance Coverage Review

G. Insurance Coverage Review

Financial setbacks often come from unexpected events.

Essential coverage includes:

Health insurance

Life insurance

Property insurance

Business insurance (if applicable)

H. Emergency Fund Adequacy

H. Emergency Fund Adequacy

An emergency fund is your financial airbag.

Rule of thumb:

3 to 6 months of living expenses

Stored in a liquid and easily accessible account

I. Retirement Planning Status

I. Retirement Planning Status

It’s never too early or too late to plan for retirement.

Review:

Retirement accounts (401k, IRA, pension)

Contributions and employer matches

Projected retirement needs

J. Net Worth Calculation

J. Net Worth Calculation

Your net worth is the ultimate financial snapshot.

Formula: Total Assets – Total Liabilities = Net Worth

Track it annually to measure your financial growth.

4. Types of Investments by Professional Field

4. Types of Investments by Professional Field

Different professions may align better with different investment strategies:

Tech Professionals:

Stock options or equity in startups

Crypto and tech-focused ETFs

Freelancers:

Real estate for rental income

Index funds for passive growth

Health Professionals:

Medical practice investments

REITs (Real Estate Investment Trusts)

Artists/Creatives:

Collectibles, NFTs (high risk)

Peer-to-peer lending

Educators:

Pension plans

Low-risk mutual funds

5. Additional Aspects to Consider

5. Additional Aspects to Consider

Tax Efficiency: Are you minimizing taxes legally?

Legal Structures: Sole proprietorship vs. LLC vs. Corporation

Financial Literacy Level: Do you understand your financial tools?

Psychology of Money: Are emotional spending habits holding you back?

6. Red Flags and Warning Signs

6. Red Flags and Warning Signs

Living paycheck to paycheck

Credit card balances carried over monthly

No emergency fund

Ignoring retirement

Uninsured major risks

Investment choices without understanding them

7. How to Take Action Post-Evaluation

7. How to Take Action Post-Evaluation

Create a budget and stick to it

Increase your income through upskilling

Automate savings and investments

Cut unnecessary expenses

Seek a financial advisor if overwhelmed

8. Final Thoughts: The Power of Knowing

8. Final Thoughts: The Power of Knowing

A financial evaluation isn’t a one-time activity—it’s a lifestyle. The more often you assess, the more control you gain. You can’t fix what you don’t measure. And in today’s volatile economic world, clarity is your greatest asset.

“What gets measured gets managed.” – Peter Drucker

Take control of your financial future. Start your financial evaluation today and transform your life one decision at a time.

Discover More of Technology Splendor: Explore Our Other Sites

Your Health is your Best Investment

Energy, clarity, and balance are the foundation of every dream. Without health, wealth loses its shine and relationships lose their spark. Discover strategies to strengthen your body, sharpen your mind, and energize your spirit.

Learn How to Protect It →Relationships Give Life Meaning

Health gives you energy. Wealth gives you freedom. But only deep, authentic relationships give life true purpose. Discover the tools to connect, love, and communicate at your best.

Improve your Personal and Business Relationships